According to CNBC, Silicon Valley Bank and Signature Bank failed in quick succession over the past few days (the second and third largest bank failures in U.S. history), That has many worried about possible contagion effects in the wider banking system. The Federal Deposit Insurance Corp. struggled to find a buyer for the failed bank's assets. CNBC previously reported that PNC Financial Services Group, which initially expressed interest, decided not to make a formal bid after conducting an investigation. Since the weekend, the Wall Street Journal, citing people familiar with the matter, has reported that U.S. regulators are planning a second auction. A weekend auction of the failed Silicon Valley Bank was fruitless. The official believes there is still an opportunity to sell Silicon Valley Bank. The Federal Reserve, the Federal Deposit Insurance Corporation and the Treasury Department announced a program to guarantee uninsured depositors at Silicon Valley Banks and Signature banks. The Fed also announced additional funding for troubled banks.

The Federal Reserve's year-long battle against inflation has suddenly become a major new worry -- a spate of bank failures, Politico reported Tuesday. That has raised concerns about US financial stability, threatening to upend the Fed's battle to tame inflation with aggressive rate hikes, and risks continue to spill over after America's 16th-largest Silicon Valley bank declared bankruptcy in just 48 hours. Us regulators announced Wednesday the closure of Signature banks, with the financial industry expecting more bank failures. Some US politicians blame the Fed's continued interest rate hikes, which have fuelled financial sector anxiety about rising rates, at the heart of the bank failures.

U.S. financial institutions could face a risky dilemma in the future, and a failure to raise rates could lead to inflation staying high for a long time, further eroding American paychecks. But if it pushes ahead, it could fuel more financial turmoil.

The string of bank failures adds a new twist to the nation's already complicated battle against inflation, which could determine whether the economy slips into recession, and the Fed may have to tread carefully to avoid a broader financial panic.

The US government is shutting down banks to prevent the banking crisis from spreading

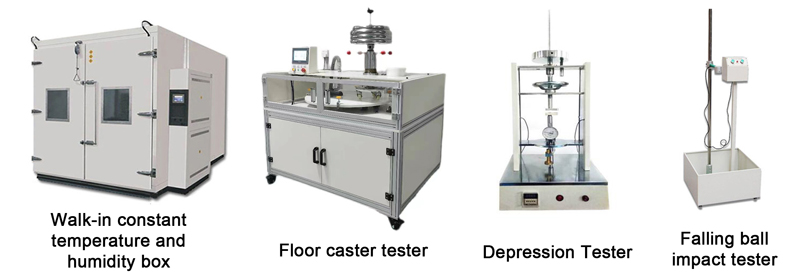

Dongguan Runzhi Electronics Co. , ltd.-the testing equipment division was established in 2011. It is a professional testing equipment brand center jointly established by professionals of electronic technology and equipment r & D for many years, set Research, development, manufacturing, marketing as one of the high-tech enterprises.

Dongguan Runzhi Electronics Co. , Ltd. mainly deals in laboratory equipment, including: Test Bench, laboratory environment tester, constant temperature and humidity chamber, aging tester, element detection combination instrument, floor residual depression meter, dimension tester, straight line angle tester, high-precision image projector, wheelchair tester, falling ball tester, falling sand tester, 90 degree peel strength tester, scratch tester, wear tester, blasting tester, tensile tester and other high-tech products.

The company operates a wide range of high quality instruments and equipment, including glossometers, whiteness meters, Energy Meters, densimeters, thermometers, viscometers, thickness meters, hardness meters, depth meters, high-precision electronic balance, caliper, gauge and so on.

Dongguan Runzhi Electronics Co. , Ltd. has many advantages, such as wide application, strong pertinence, wide variety, complete functions, excellent quality, sufficient stock, reasonable price and after-sales guarantee. With the joint efforts of Dongguan Runzhi Electronics Co. , Ltd. and many customers, our products and services are becoming more and more perfect. Have been invited to visit a number of well-known enterprises to provide advice and on-site guidance, has been the majority of customers, welcome new and old customers call letter advice: 13712847488 Mr. Zheng or runzhi0769@163. Com